Expanding your business to South East Asia

In recent years Vietnam has evolved from a rising star to “The Shining Star” for business expansion. Showcasing strong growth across multiple sectors of the economy, Vietnam is a perfect base for business expansion in South East Asia. In this report we aim to provide a holistic view of the market situation and outlook for companies looking to enter the market.

Is there a market?

Before establishing a presence in a new market, one should always begin with the question – “Is there a market?”. Two general indications for answering the question are stable economic growth and population size.

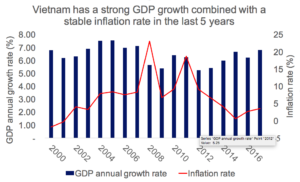

After the Doi Moi reforms in 1986 Vietnam has emerged from an underdeveloped and uneducated country to become one of the fastest growing economies worldwide and came in at 12th place for the overall ranking of math and sciences in the 2015 year’s PISA rankings, beating countries such as Sweden, UK and the USA. From the successful implementation of the Doi Moi reforms, where Vietnam ended their centrally planned five-year economic policies and adopted a more decentralized system. Current GDP growth has averaged above 6% over the last decade and with further policy changes aimed at attracting foreign capital this development shows no signs of slowing down.

Sources: World Bank, IMF

Alongside the country’s economic and educational growth, the population of Vietnam is increasing, from the country’s current population of 95 million it is expected to reach 100 million by 2025.

Returning to the question of “Is there a market?” As seen on the macro factors, Vietnam has a strong economic development and growing population making it appropriate for expansion in South-East Asia.

Main market drivers for growth

Vietnam holds an exceptional position as a transitioning economy with rising income divided fairly equally across the population, and the fastest growing middle class in South-East Asia. Currently 20 million Vietnamese are part of the global middle class and forecasts by the World Bank estimates that it will increase by 250%, reaching 50 million by 2035.

The increased spending power constitutes a strong driver for consumer demand for top quality brands, higher convenience and service functionality. As the middle class is still transforming with high demand for new products and services, now is a good time to influence their taste.

Alongside consumer goods, the upcoming middle class is spending more on services such as education, healthcare, insurance, technology and financial services.

Demand for convenience & availability, due to the rapid lifestyle of the young Vietnamese population, is transforming a traditional retail landscape of wet markets and mom & pop stores, towards modern retail with super markets, international chains and a booming E-commerce. The forecast (1) is that modern retail will reach 45% of the retail landscape by 2020, up from 25% in 2015. With the market turning towards modern retail and e-commerce, distribution networks are evolving to keep up with the changing landscape, together these factors open for foreign entrants and new ways to reach customers

From risk to opportunity

Expanding Your business to a new region is challenging and involves several common pitfalls. Taking the time to conduct proper research and have first-hand experience of the market is key to a successful expansion. For Western companies looking to enter Vietnam and South-East Asia, questions regarding attitudes to foreign brands and companies as well as general questions on doing business in Vietnam becomes especially relevant.

In Vietnam consumers associate western brands as high quality and premium. There are many international brands already available for the local market and although they come with a price premium the growing demand for quality will increase the opportunities for western brands.

Simultaneously Vietnamese brands are refining their products and services, increasing competition. However, due to the rapid expansion, there is place for a wide range of new players. Key to succeed is the ability to adapt to changing consumer behavior in this young market.

Common ways of entering a new market is through partnerships or establishing a local branch. Working together with a local partner, gives the advantage of quick access to the South-East Asian business culture and local regulations, although it is not always easy to find the right one.

Other routes include acquiring or setting up a joint-venture with an existing enterprise. After joining the WTO in 2008, Vietnam has gradually lifted regulations for tariffs and foreign investors and companies looking to establish local presence. In 2015 the government lifted a regulation, limiting foreign ownership in listed entities below 49%, which sparked an increase in M&A activity and Foreign Direct Investment (FDI) – in the last 5 years FDI has had a CAGR of 12.9%.

In addition, Vietnam has established South-East Asia’s largest network of Free Trade Agreements (FTAs) alongside Singapore. Recent additions include the EVFTA (EU-Vietnam Free Trade Agreement) which is to be ratified early 2019 and eliminates 99% of all tariffs between the EU and Vietnam over a 7-year period. It will also be an important driver for FDI inflow in Vietnam for both products and services.

Main Customer segments on the move

Although the developments will have a positive impact on the whole society, two main demographic drivers will affect the changing demand significantly, namely the young urban adults and the elderly.

Young adults (<35 years), currently account for 60% of the population. This group is moving from rural areas and jobs in agriculture to the cities, attending universities and to work in the increasing service and manufacturing sector. In the upcoming decennium this group will account for the major changes in market demand. With high smartphone penetration and internet connectivity, this generation of young Vietnamese have adopted a more rapid lifestyle corresponding to the country’s swift pace. They are becoming the backbone of Vietnam driven by technological innovations, increasing their self-expression and improved living standards. With increased living standards life expectancy is expanding the number of elderly people, estimating it to include 20% of the population in 10 years. This pose a huge challenge for Vietnam as their needs for healthcare, pharmaceuticals and financial services (pensions savings) will put a strain on public spending. Currently Vietnam is lacking adequate welfare services for elderly as they are traditionally taken care of by their families. However, with young people moving into the cities leaving their parents behind the demand for social services will increase.

The public pension system is also built around people mainly working in governmental organizations and with people moving towards the private sector, there is a risk of public spending on pensions becoming too large. Considering the shift from an agricultural to a manufacturing and service-based economy the division between rural and urban areas is expected to also pose a challenge going forward.

These four growth drivers are the foundation to Vietnam’s place as South-East Asia’s shining star. Over the next decade Vietnam is expected to become a major hub for trade between Asia and the Western world. As a company looking to do business in Asia, the opportunities in Vietnam has huge potential with increasing income and demand for new products.

Notes: (1) Vietnam’s distribution and retail channels, Edition 2018 (EVBN)

Why Vietnam?

Considering Vietnam as the next stop and you want to stay close to the facts?!

TBRC is undoubtedly a good partner to expand your business!